Interested investors will have the option of applying for financing through state-owned bank PT Bank Mandiri and promptly entering into cooperation with state-owned energy company PT Pertamina, which has been tasked with providing and distributing LPG to the public.

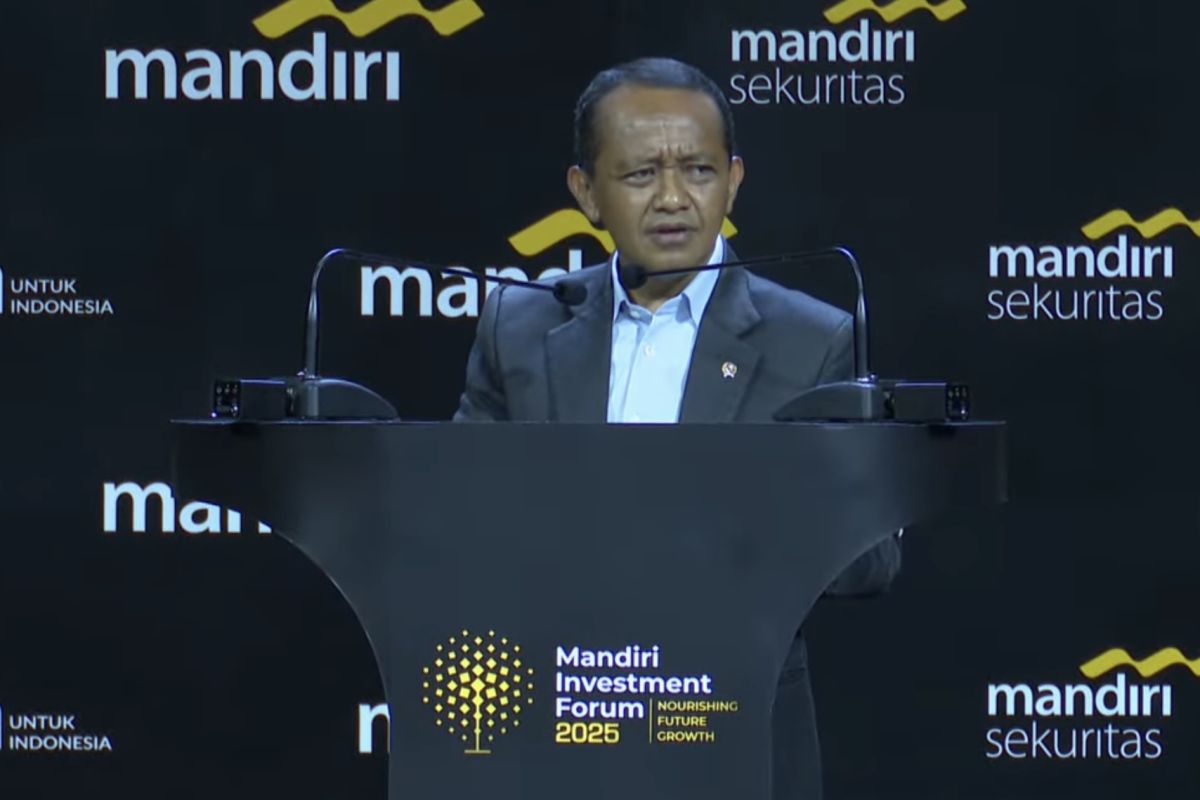

"I invite all of you, ladies and gentlemen, investors who are willing, please build LPG factories. With the financing from Bank Mandiri, this is a very captive market as it is directly contracted with Pertamina," the minister said at the Mandiri Investment Forum 2025 here on Tuesday.

In 2024, he pointed out, national LPG production was only 1.97 million metric tons (MT), while LPG consumption stood at 8.23 MT for subsidized and 0.67 million for non-subsidized LPG.

To meet this gap, Indonesia had to import 6.91 million MT of LPG last year.

The government is building a national gas network facility to expand the domestic gas supply and meet the needs in Java and Sumatra.

"To cover the gas supply from Sumatra, from East Java, we are building a gas pipeline as a 'toll road' to meet the needs in Sumatra and Java," Lahadalia informed.

He further revealed that Indonesia's oil lifting has experienced a significant decline to reach 500–600 thousand barrels per day.

The number would not be in balance with the national oil needs or consumption of around 1.5 to 1.6 million barrels per day, he said.

In 2024, national oil production was recorded at 212 million barrels, but imports reached 313 million barrels, comprising 112 million barrels of crude oil and 201 million barrels of fuel.

Last year, national fuel consumption was recorded at 532 million barrels, with the transportation sector accounting for 52 percent of the consumption.

"Indonesia's foreign exchange must lose more than Rp500 trillion due to oil imports, and this may also be one of the factors why the rupiah exchange rate against the dollar has weakened," Lahadalia said.

"This is the law of supply and demand; if we need a lot of dollars, then our exchange rate will be corrected. Imagine, more than Rp500 trillion per year, our trade balance is corrected, (as well as) the balance of payments and the country's foreign exchange," he added. (US$1 = Rp16,350).

Related news: Develop LPG industry to reduce imports: Indonesian official

Related news: RI must produce additional 2 tons of LPG annually: minister

Translator: Arnidhya Nur Zhafira, Yashinta Difa

Editor: Primayanti

Copyright © ANTARA 2025