With this policy, some US$3 billion could be saved on diesel fuel imports."Jakarta (ANTARA News) - The Ministry of Industry has issued a package of policies to maintain the growth of national industries affected by current financial market conditions and the rupiah depreciation.

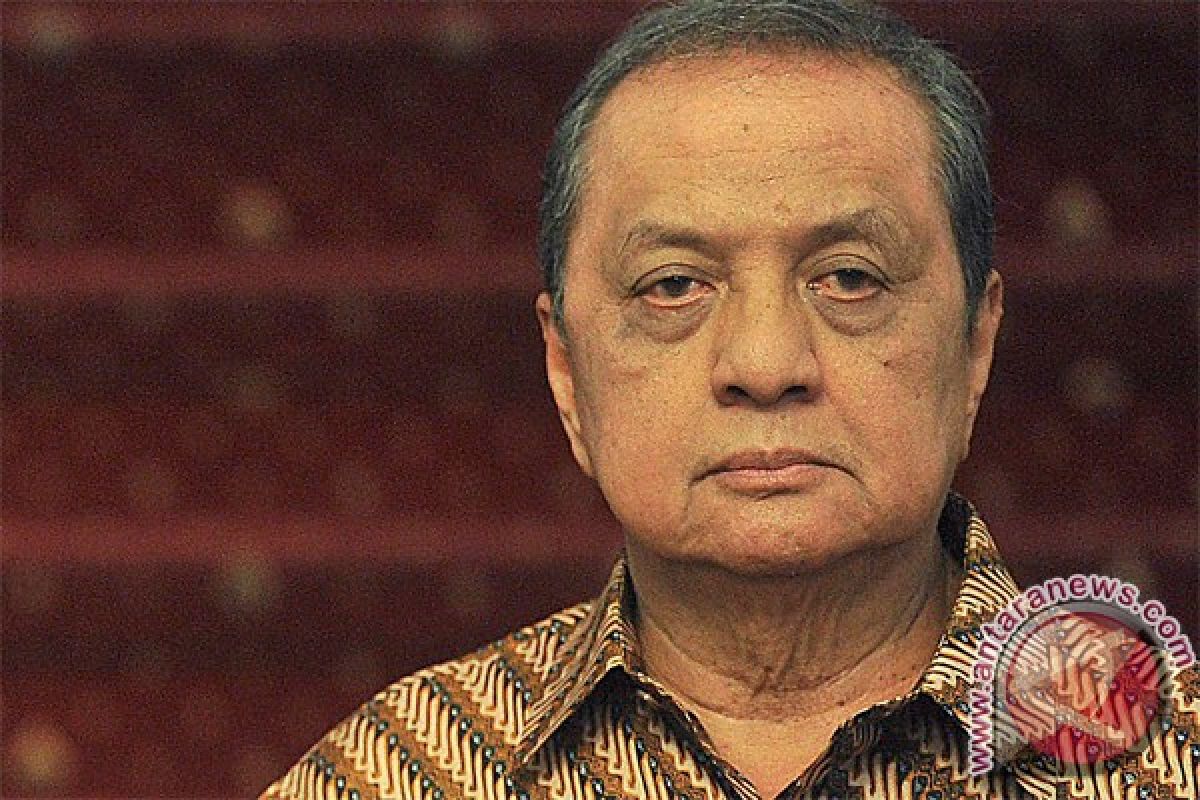

Industry Minister MS Hidayat announced at a press conference here on Wednesday that the package of policies was being released as a follow up to those issued by the government last Friday.

"We expect the current economic conditions will affect economic growth, including industrial growth. As a result, the government has taken steps to maintain economic stability, especially in the industrial sector," he stated.

To improve the current account deficit and the rupiah exchange rate, the government will reduce imports of oil and gas by encouraging the use of bio-diesel and increasing the sales tax on luxury cars, he remarked.

He pointed to the 10 percent increase, for a total of 3.5 million kiloliters, in the allotment of bio-diesel.

"The supply of 3.5 million kiloliters of bio-diesel can be met domestically because the installed capacity has now reached 5.6 million kiloliters," he added.

He said consumption of bio-diesel as a source of energy for motor vehicles and industries has reached only 669 thousand kiloliters, which is only 1.91 per cent of the 3.5 million kiloliters needed.

"With this policy, some US$3 billion could be saved on diesel fuel imports," he stated.

In implementing the policy, the minister claimed he would ensure that companies remained committed to meeting all bio-diesel needs in the domestic market; push car dealers to continue guaranteeing the cars they sell, even when these cars utilize up to 10 percent bio-diesel (B-10); and familiarize himself with the technical aspects of using bio-diesel in industries in general and car manufacturing industries or those that use engines and power-generating equipment in particular.

The minister also noted that the luxury automotive sales tax will be increased by 25 to 50 percent. The tax on imported luxury cars with engines above 3 thousand cc, totaling some 7,000 units in 2012, was originally fixed at around 75 percent.

"To reduce imports of luxury cars, the government has increased the sales tax to 100 percent," he confirmed.

The minister stated that his office would also provide a short-term incentive in the form of a reduction in income tax, based on Article 25, and a suspension of income tax, based on Article 29.

He said his office would make a list of industrial companies and would issue a ministerial regulation for companies that are eligible to take advantage of the tax benefit.

He claimed his office would relax restrictions on companies in bonded zones by allowing them to sell 50 percent of their products in the domestic market.

"We will recommend that companies in bonded zones, with easy access to the domestic market, should sell more than 50 percent of their products at home via the Excise and Customs Directorate General," he explained.

He said the government will also revoke the luxury tax for commodities that are no longer categorized as luxury goods, such as freezers, air conditioners, and sanitary goods.

Over the long term, he noted he would improve the tax allowance for investment incentives by widening the coverage of affected businesses and simplifying procedures.

"We will propose additional industries or new industries for tax allowances," he confirmed.

The third policy, he stated, is to boost investments by revising the presidential regulation on the negative investment list and pushing for faster downstream industrial development of metal and minerals-based industries.

(Reporting by Juwita Trisna Rahayu/Uu.H-YH/INE/KR-BSR/O001)

Editor: Priyambodo RH

Copyright © ANTARA 2013