Meanwhile, the index of the 45 most liquid stocks, or LQ45, depreciated by 2.86 points, or 0.28 percent, to 1,011.62.

"Inflation records is below the analyst's forecast and an estimation of Purchasing Manager Index (PMI) predicted by Manufacturing Indonesia is below than 50 which signals there may be a contraction at manufacturing industry in the country. That may cause IHSG to plunge further," an analyst of Binaartha Securities, M Nafan Aji Gusta Utama, expounded in Jakarta, Thursday.

At the opening, IHSG had risen to 13.59 points, or 0.22 percent, to 6,313.13. Meanwhile, the index of the 45 most liquid stocks, or LQ45, rose by 2.68 points, or 0.26 percent, to 1,017.

During Thursday's transactions, net foreign buy reached Rp170.26 billion, while 5.3 billion shares worth Rp4.17 trillion were traded at the market.

In the mean time, regional markets that strengthened this evening comprised Hang Seng Index at 353.77 points, or 1.25 percent, to 28,543.52; and the Straits Times Index rose 29.17 points, or 0.91 percent, to 3,252.

Related news: Inflation rate throughout 2019 at 2.72%: BPS

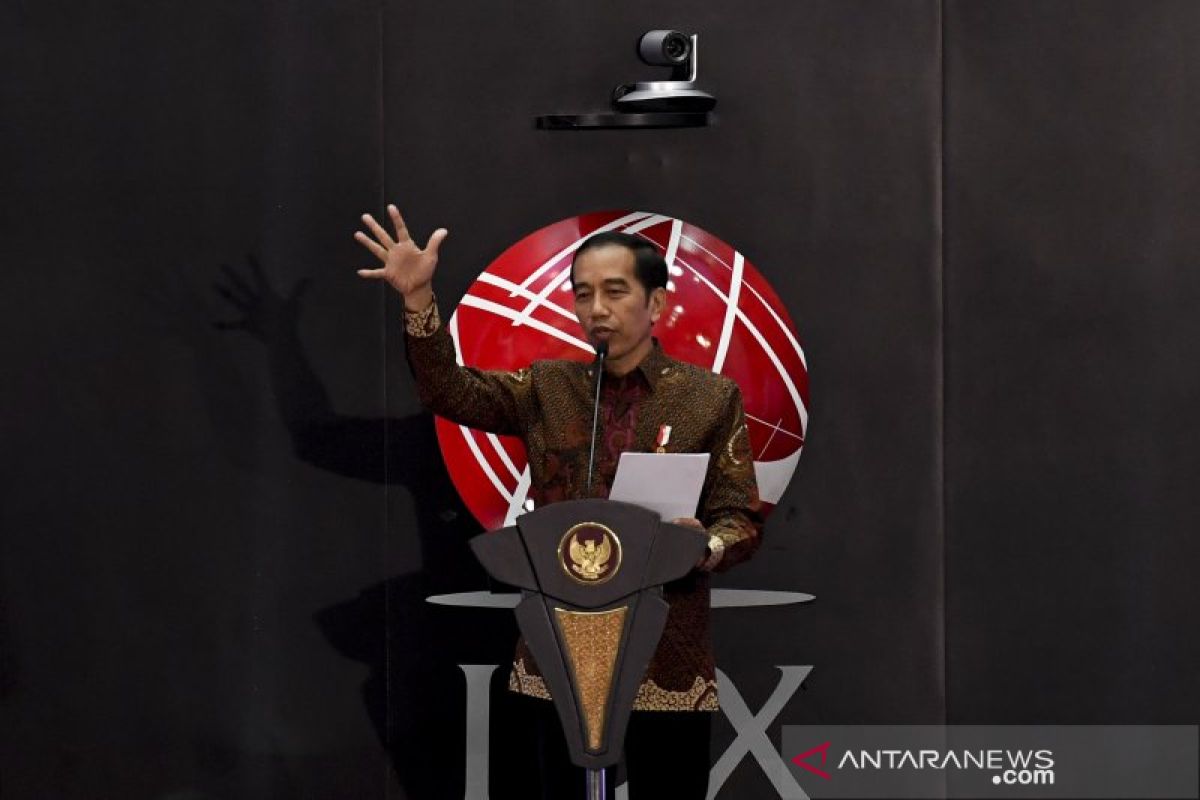

Related news: Jokowi kicks off stock trading in 2020, IHSG opens higher

Translator: Citro Atmoko/Genta Tenri Mawan

Editor: Rahmad Nasution

Copyright © ANTARA 2020