The confidence of investors, including foreigners, in the condition of Indonesia's economy is getting better, and that has been proven by the flow of foreign capital into government bonds (SBN)Jakarta (ANTARA) - Bank Indonesia (BI) revealed the flow of foreign capital into Indonesia has begun to rise from the first week of June this year, reaching Rp7.01 trillion, on the back of improving investor confidence in the country’s economy.

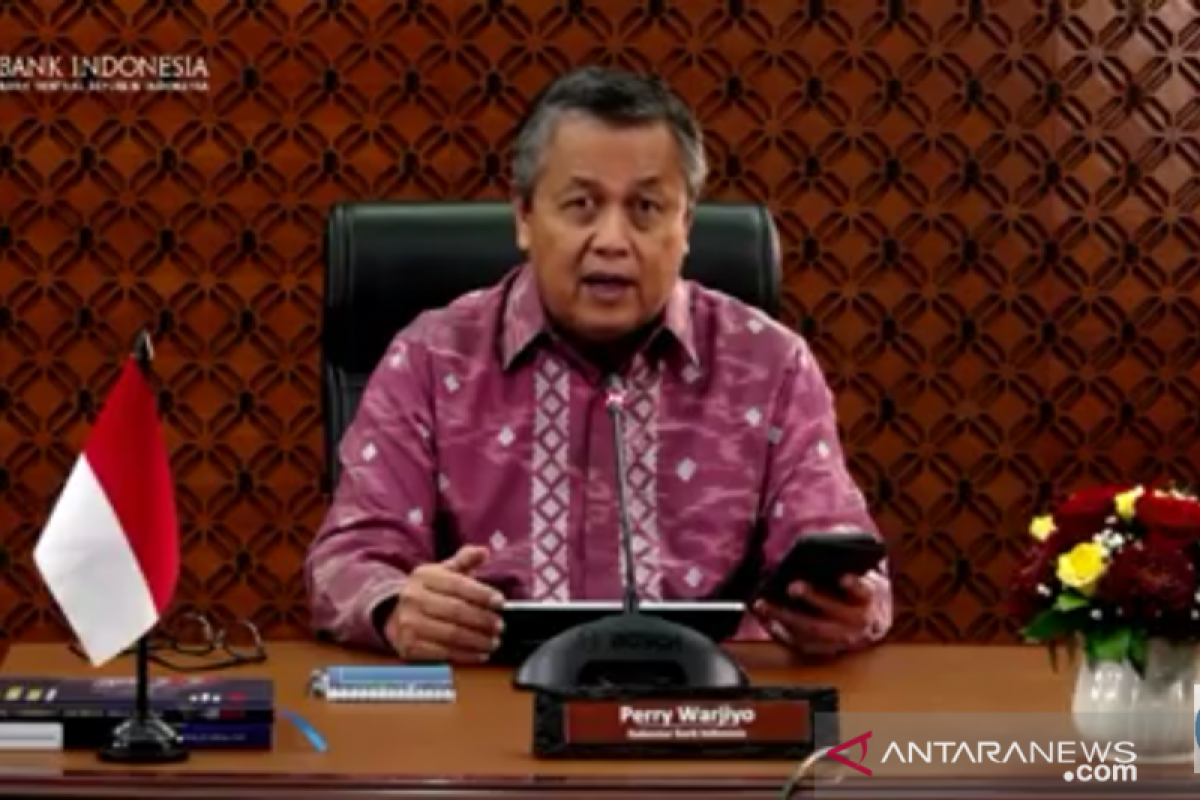

"The confidence of investors, including foreigners, in the condition of Indonesia's economy is getting better, and that has been proven by the flow of foreign capital into government bonds (SBN)," BI Governor Perry Warjiyo said in an online press statement here on Friday.

The BI Governor revealed that since the second week of May, 2020, foreign investment has continued to flow into government bonds (SBN) and bond instruments, reaching Rp2.97 trillion.

In the third week of May, it totaled Rp6.15 trillion; in the fourth week, it stood at Rp2.5 trillion; and, in the first week of June, it was registered at Rp7.01 trillion.

With foreign capital flowing into Indonesia, Perry added, the country’s foreign exchange reserves would also certainly increase, and climb higher than in the month of May this year.

However, the Governor is yet to reveal the position of Indonesia’s foreign exchange reserves for the month of May, although an announcement is expected on Monday (June 8, 2020).

"With the rupiah strengthening, the market mechanism is running, the need for BI intervention has reduced, and (with) the greater inflow of capital, of course, foreign exchange reserves are increasing," Perry stated.

Indonesia’s forex reserves were pegged at US$121 billion in March this year, and showed an increase in April, reaching US$127.9 billion, due to the issuance of government debt. (INE)

Related news: BKPM to revise investment realization target affected by COVID-19

Related news: BKPM, Foreign Ministry intensify coordination to boost investment

EDITED BY INE

Translator: Dewa K, Azis Kurmala

Editor: Fardah Assegaf

Copyright © ANTARA 2020