The zakat law stipulates that stocks are included as assets that should be paid as zakat.Jakarta (ANTARA) - The Commission Fatwa Ijtima of the Indonesian Ulema Council (MUI) stipulated that shareholders are obligated to pay zakat (alms) in accordance with the stock values and zakat provision.

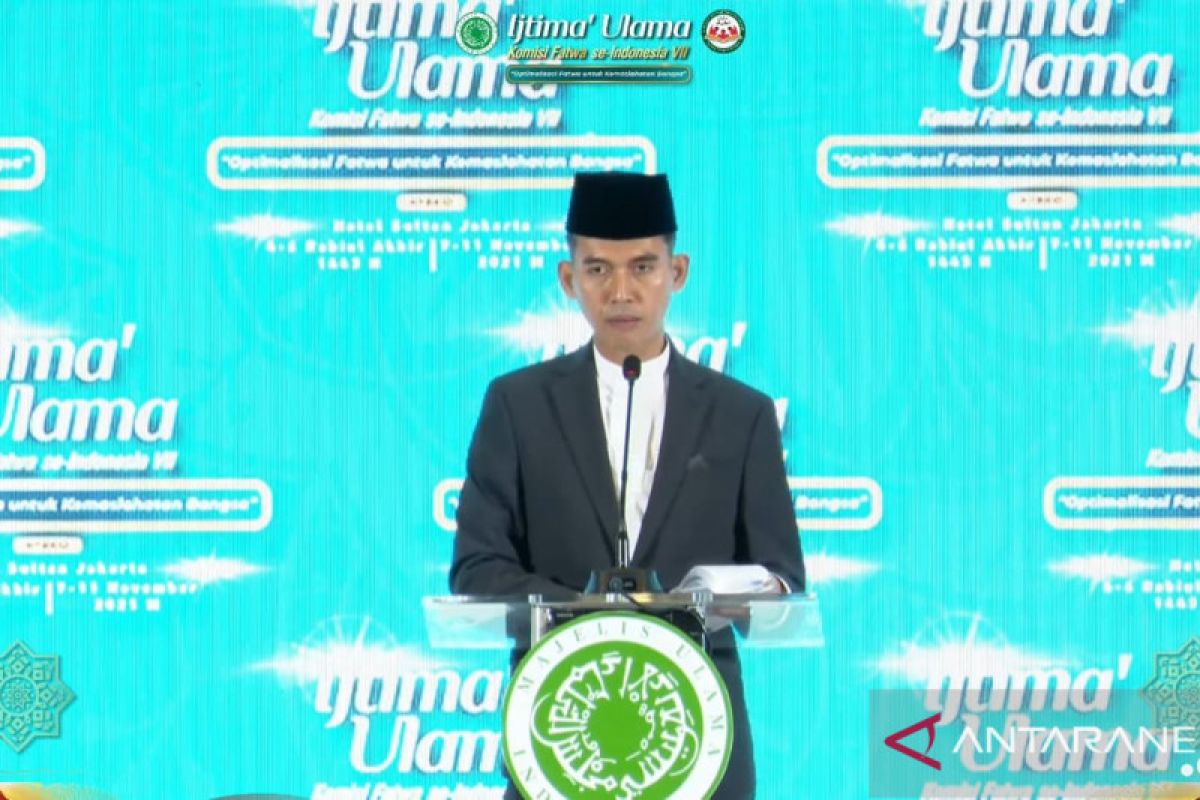

“The zakat law stipulates that stocks are included as assets that should be paid as zakat,” MUI’s fatwa commission head, Asrorun Ni’am Sholeh, stated during an online press conference here on Thursday.

Some provisions necessitate shareholders to pay the asset alms based on the conditions that they are Muslims, their stocks are perfectly possessed, and they have owned the stocks for a year, according to MUI.

The one-year stock ownership period does not apply to shareholders of livestock, agriculture, and treasure companies, the council added.

Related news: Baznas projects zakat collections to reach Rp3.5 trillion in Ramadhan

Apart from stock alms, the council also stipulates the alms that the companies are obligated to pay.

“The law stipulates that the companies’ assets that have met the alms requirements are obligated to pay the alms,” Sholeh noted.

The companies’ assets that should be paid as alms are the current assets, the firm's funds invested in other companies, and physical assets managed by the rental business and other businesses.

The assets should have achieved the one-year ownership period and have fulfilled the nisab, or minimum requirement value, and certain measurement based on its business sector, Sholeh stated.

Related news: 28 countries to participate in World Zakat Forum in Bandung

Translator: Aditya Ramadhan, Juwita Trisna

Editor: Rahmad Nasution

Copyright © ANTARA 2021