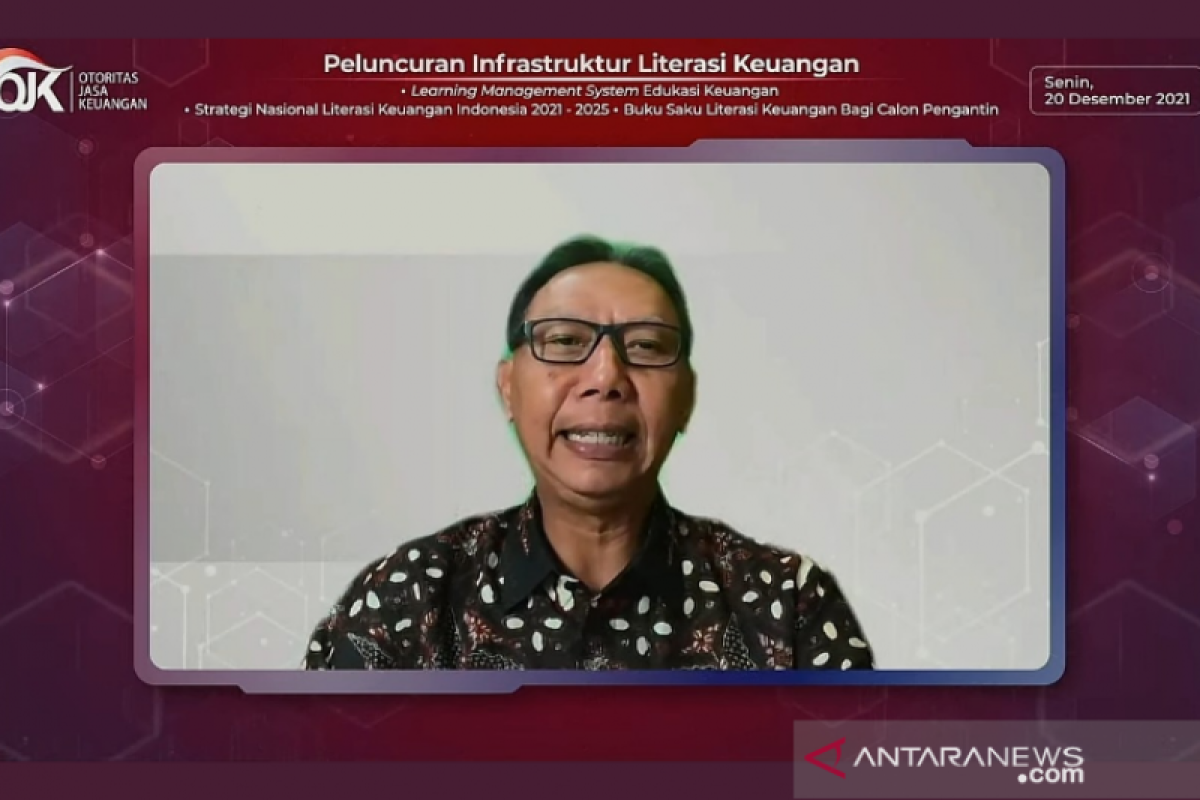

"The G20 presidency in Italy has underlined financial literacy as an essential life skill to empower communities, support the welfare of individuals and communities, and help (increase) financial inclusion for consumer protection and economic recovery post-pandemic," Segara noted at the launch of financial literacy infrastructure here on Monday.

To this end, Segara expressed belief in the society's enrichment through financial literacy that will eventually support the goal of financial system stability and encourage more inclusive development, thereby increasing the community's resilience and well-being.

In recent years, the financial services sector has grown rapidly and offered individuals enormous opportunities to access financial products and services.

Hence, he opined that the acceleration of technology and information in the financial sector accompanied by the implementation of health protocols due to the COVID-19 pandemic has made digitalization a new business option.

"I am grateful that financial services institutions are continuously adapting to maintain their existence to support the needs of consumers by continuing to innovate in digital finance that is more efficient, safer, and faster, as well as prioritizes health aspects in the midst of the pandemic," he explained.

However, as the levels of financial and digital literacy are still low, some new challenges and risks also emerge, he pointed out.

According to 2019's results of the National Survey of Financial Literacy and Inclusion, Segara noted that only 38 percent of the public had an adequate understanding of financial products and services, much lower than the percentage of consumption of financial products, at 76 percent.

Hence, Segara believes several people using financial services products were still not equipped with the necessary skills, such as the understanding of fines.

To this end, he pointed out that all policies in improving financial literacy are crucial to be implemented together.

Related news: Growth in financial literacy lags digital product innovations: OJK

Related news: Bibit.id strives to help boost financial literacy among youth

Related news: Digital financial education for young investors appreciated: analyst

Translator: Agatha V, Kenzu T

Editor: Sri Haryati

Copyright © ANTARA 2021