With this, the total number of BI-FAST participants has reached 43, who together represent 81.45 percent of the national retail payment system, communication executive director at Bank Indonesia, Erwin Haryono, said here on Monday.

The increase in BI-FAST participants reflects the central bank's commitment to boosting economic digitalization and national finance, he added.

BI-FAST can be accessed through applications made by the payment system industry for facilitating retail payment transactions for the public, he informed.

Related news: Foreign capital outflow of Rp5.34 trillion in Jan fourth week: BI

The implementation of BI-FAST by participants for their customers will be carried out gradually, based on each participants' strategy and plan for preparing payment channels for their customers, he said.

In the second stage, Indonesia Central Securities Depository PT Kustodian Sentral Efek Indonesia (KSEI), the non-bank institution that has started to implement BI-FAST, would support transaction digitalization in the stock market, Haryono informed.

Further, BI-FAST services will continue to be expanded step-by-step to include the services of bulk credit, direct debit, and request for payment, he added.

Related news: BI projects economy to grow at swifter pace in 2022

Hence, BI expects the support of all payment service providers (PJPs) for BI-FAST, which will serve as the backbone for future retail payment systems, he said.

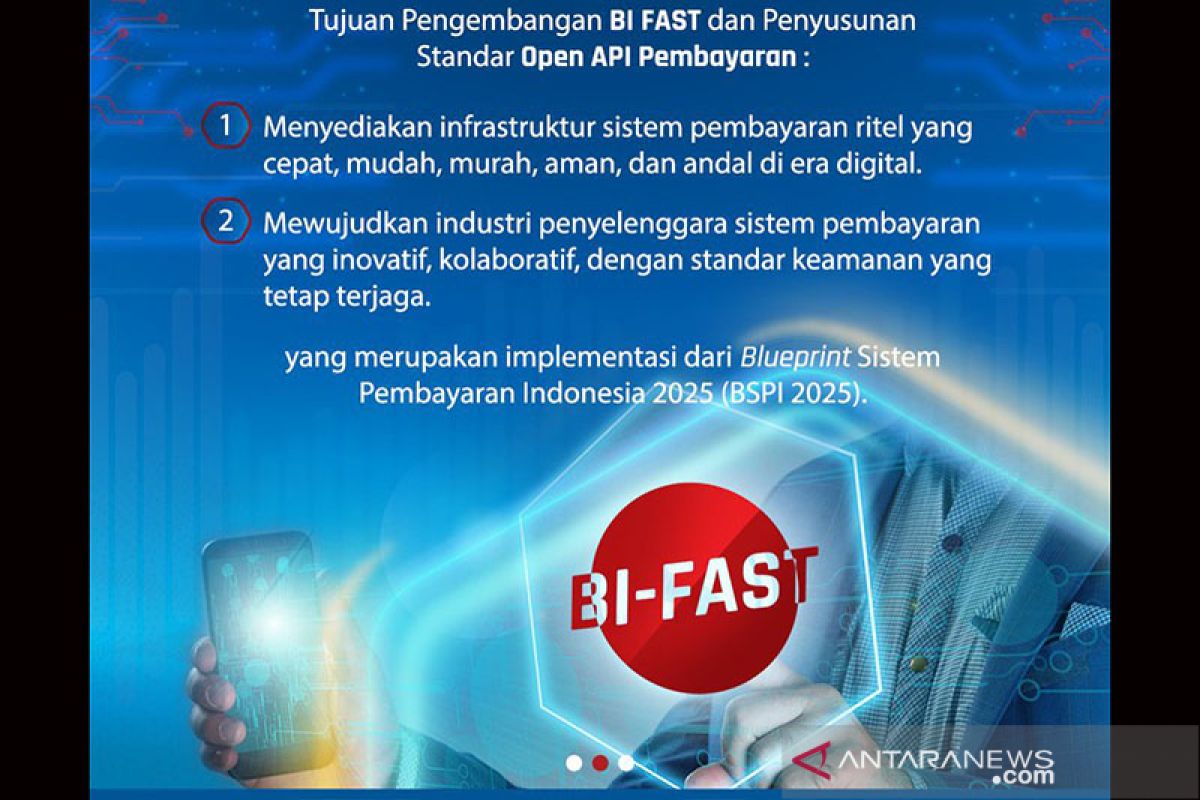

According to Haryono, BI-FAST can accelerate payment services through many instruments and channels and the services are real-time, safe, easy, quick, reliable, cheap, and round-the-clock, thus it can bolster economic recovery and growth as well as financial inclusion.

He emphasized that the central bank will continue to strengthen policy synergies between BI-FAST and industry players to integrate the national digital financial economy.

BI-FAST is expected to support industry players in creating innovations by optimizing the added value of consumer-centric services to improve financial inclusion and accelerate economic recovery through transaction efficiency, he added.

Related news: NU should build endowment fund: Jokowi

Related news: Singaraja River overflows, floods hundreds of homes in Cirebon

Translator: Agatha V, Kenzu T

Editor: Fardah Assegaf

Copyright © ANTARA 2022