So there is almost no difference between our urban and rural areas on financial inclusion and financial literacy level as wellJakarta (ANTARA) - Bank Indonesia (BI) is striving to increase economic and financial inclusion through community empowerment in urban and rural areas.

"We are developing projects to increase economic and financial inclusion in rural and urban areas," Head of the Department of Micro, Small, and Medium Enterprises (MSMEs) Development and Consumer Protection at BI, Yunita Resmi Sari, said at the 'OJK Seminar on Economic Inclusion' held by the central bank here on Thursday.

At the seminar, which was organized as part of the Meeting of Finance Ministers and Central Bank Governors (AFMGM) agenda, Sari observed that the gap between the level of inclusion and the level of financial literacy in urban and rural areas is very small.

"So there is almost no difference between our urban and rural areas on financial inclusion and financial literacy level as well," she pointed out.

However, when making provincial comparisons, a large gap has been detected between the province with the highest level of financial inclusion and the province with the lowest level of financial inclusion.

This has been determined from the use of QRIS payments in Indonesia: so far, the number of QRIS users has reached around 36 million. When compared by region, Java Island has been found to dominate in the use of QRIS payments.

A global survey in 2021 showed that 70 percent of adults in Indonesia do not have a bank account because they do not have enough savings.

"They don't have money, therefore they don't have a bank account," Sari noted.

Therefore, to promote financial inclusion, Bank Indonesia is taking measures to empower communities so that they become economically inclusive.

To empower communities, the central bank is collaborating with academics and NGOs so that they become facilitators to assess the economic potential of communities. In addition, BI is also supporting capacity building.

After a community succeeds in creating their own economic activities, BI helps provide the community members access to markets — conventional, retail, as well as digital markets.

BI also supports access to financial services besides conducting monitoring and evaluation, including evaluating economic activities, as reflected in the sales value and turnover generated by the community groups it empowers.

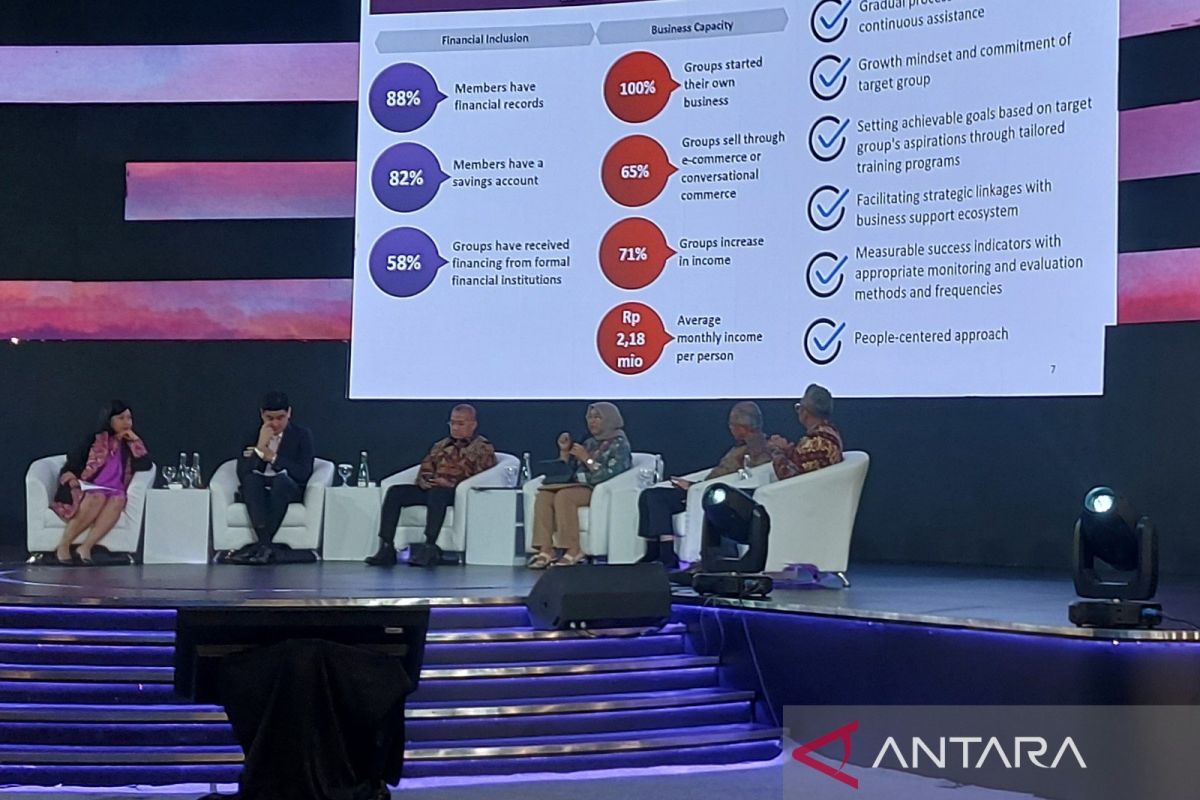

According to BI, through the community empowerment project, 100 percent of the empowered community groups have managed to establish their own business activities and sell their products using e-commerce. Their incomes have also increased significantly.

Related news: Digital finance system can expand financial access: Minister Hartarto

Related news: Financial technology to continue boosting financial inclusion in RI

Related news: APEC to deepen partnerships to enhance sustainability and inclusion

Reporter: Katriana

Editor: Sri Haryati

Copyright © ANTARA 2023