Head of the Sub-Directorate of Management and Cash Expenditure of the Finance Ministry Dayu Susanto affirmed that the launch of the Initial State Revenue Transactions through digital wallets as Other Perception Agency (LPL) is part of the efforts to disseminate information aimed at enabling taxpayers to directly utilize the innovation of the Electronic State Revenue System for the Third Generation State Revenue Module (MPN G3).

"Let us optimize the Other Perception Agency payment channel, including DANA in the MPN G3, to realize the spirit of achieving the State Revenue target through amped up performance that is more synergized with stakeholders," he noted in a written statement on Saturday.

The DANA digital wallet is the main choice out of the 91 collection agents registered in the Electronic State Revenue System for MPN G3, as the LPL.

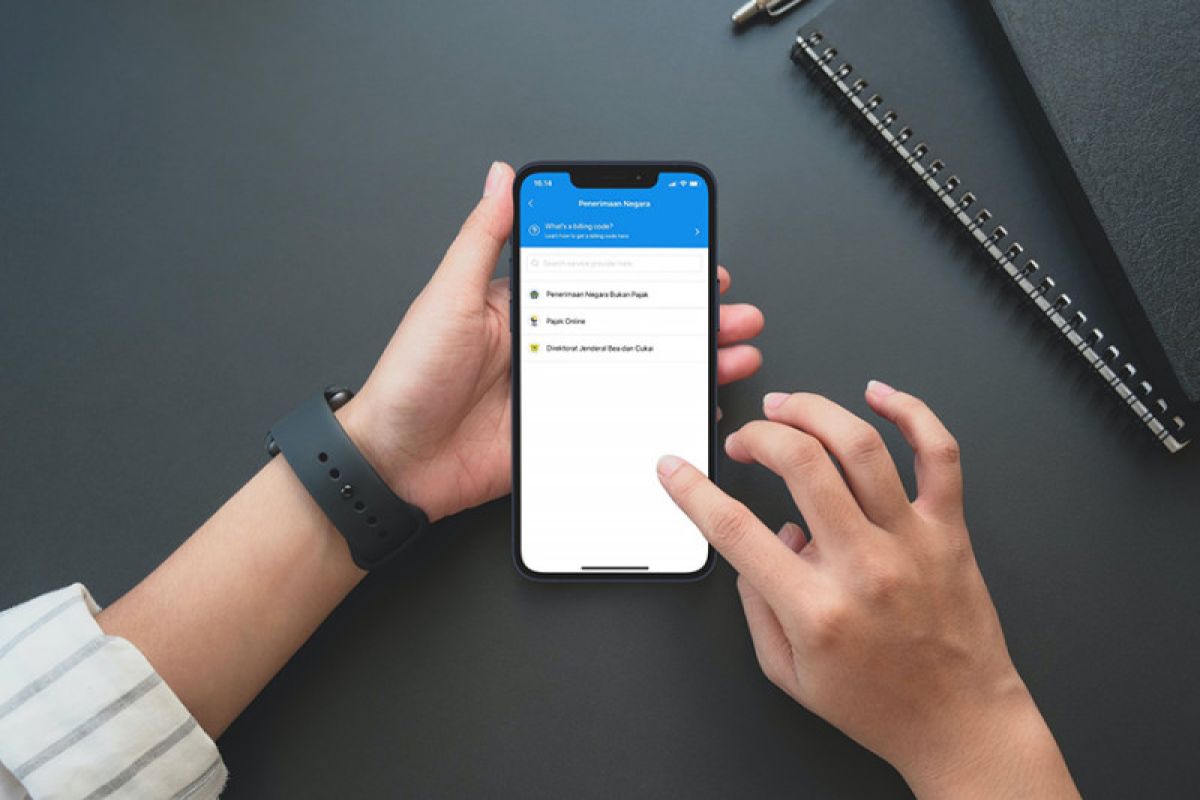

With DANA appointed as the MPN G3 collecting agent, the public, especially DANA users, can now fulfill their tax payment obligations efficiently, safely, and easily through a single integrated application.

Three types of state revenue payments can be made through the DANA application: online tax payments (DGT), Customs and Excise (DJBC), and non-tax state revenues (PNBP), such as passport renewal fees, issuance of new driving licenses (SIM) and extensions.

MPN G3 is a system created by the Directorate General of Treasury of the Finance Ministry to manage income in an accurate and timely manner.

This system was also created to offer better services to the community, especially in fulfilling the obligation to pay taxes and other state revenues.

MPN G3 offers greater advantages than its predecessors, such as being able to serve state revenue payments of up to one thousand transactions a second, from only 60 transactions per second on MPN G2.

Related news: JCB and NTT Com to demonstrate multifunctional mobile wallet app

State revenue deposits at MPN G3 can also be made through payment channels offered by the collecting agent, for instance, through counters (tellers) and electronic system payment channels, such as Automated Teller Machines (ATM), internet banking, mobile banking, overbooking, Electronic Data Capture (EDC), electronic wallets, bank transfers, virtual accounts, debit cards, and credit cards.

MPN G3 was developed through collaboration between the Finance Ministry and several collecting agents comprising perception banks/posts and other perception institutions, such as fintech companies, e-commerce, and retailers.

DANA is a digital wallet application set by the Finance Ministry to be one of the MPN G3 payment channels. Through DANA's appointment as one of the collecting agents, the implementation of electronification is a strategic step and is believed to contribute positively to the expansion of payment channels and make it easier for the public to pay for over 900 types of state revenues.

It is not the first time that the government has placed trust on DANA. Earlier, DANA was also appointed as one of the partners for the distribution of incentives for the Pre-Employment Card Program. DANA is additionally involved in some of the government programs to encourage the digitization of MSMEs, including the #BanggaBuatanIndonesia (Proudly Indonesian Made) campaign and 12 million QRIS.

"Hopefully, DANA's involvement in providing State Revenue (services) would encourage people to fulfill their obligations to the state and be able to actively contribute to economic development," CEO and Co-Founder of DANA Vince Iswara affirmed.

Related news: Finance minister lauds digital tax payment feature

Translator: Suryanto, Mecca Yumna

Editor: Suharto

Copyright © ANTARA 2021