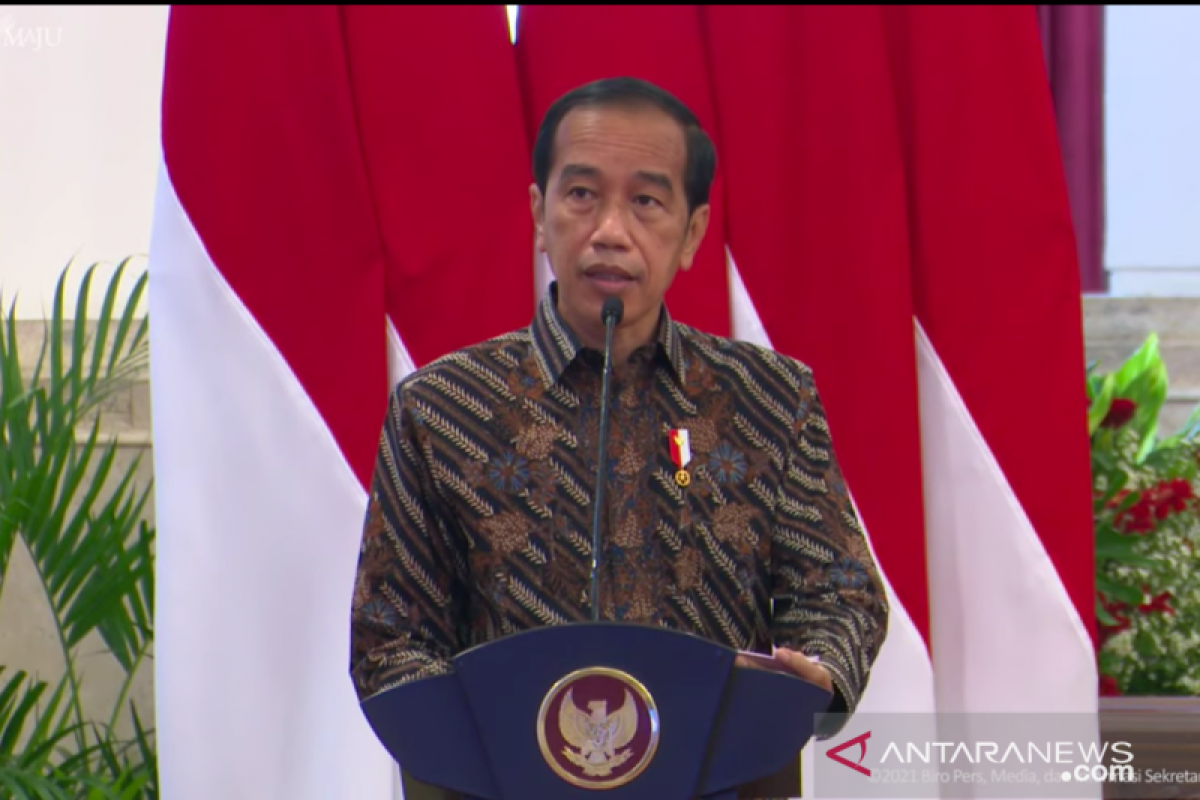

"I urge the entire financial services industry to implement financial and digital literacy programs starting from the village level to facilitate entrepreneurship with low risk at each region," President Jokowi noted in a statement at the State Palace, Monday.

President Jokowi made the statement during his keynote speech at the Financial Services Authority (OJK) Virtual Innovation Day 2021.

"With a strong and sustainable digital financial ecosystem, we must continue to maintain acceleration of an inclusive national economic movement and contribute more to economic recovery," he remarked.

According to President Jokowi, micro, small and medium enterprises (MSMEs) were eagerly awaiting commitment, partisanship, and hard work of the financial service sector to bounce back from the impact of the COVID-19 pandemic and be facilitated to make the most of new opportunities.

Related news: Young generation must exercise caution in using Fintech services: APPI

"This momentum must be continued through efforts to build a strong and sustainable digital financial ecosystem that is responsible, with risk mitigation of possible legal and social problems," President Jokowi affirmed.

Risk mitigation of legal and social problems aims to prevent losses and increase protection to the public.

"The technology based-financial service (Fintech) must also be encouraged to ensure easy access to people, support MSMEs with more digital transactions, and help MSMEs to enter the realm of digital financing," President Jokowi noted.

The head of state is also optimistic that the OJK and business owners would offer more financial inclusion to the public by providing financial and digital literacy. The project is expected to offer benefits to the community and encourage inclusive economic growth, especially to the lower middle class.

"It is one of the solutions to suppress social inequality and reach a level of society that had not been covered by the conventional financial system," he affirmed.

President Jokowi also advised digital financial service providers to also be Indonesia-centric, wherein digital financial literacy reaches remote areas across the country. Related news: Financial literacy education got a boost during pandemic: OJK

Translator: Desca Lidya N, Resinta S

Editor: Rahmad Nasution

Copyright © ANTARA 2021