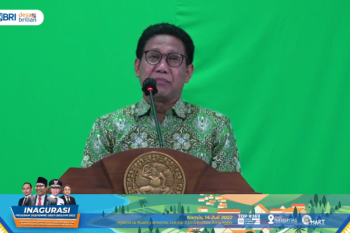

#bi governor

Collection of bi governor news, found 556 news.

G20 Indonesia

G20 nations have agreed on the majority of the results of the 3rd Finance Ministers and Central Bank Governors (FMCBG) ...

G20 Indonesia

Bank Indonesia (BI) Governor Perry Warjiyo has called upon all G20 members to commit to working together to support ...

Bank Indonesia (BI) and the Reserve Bank of India (RBI) agreed to expand payments system cooperation and strengthen ...

North Sulawesi province exported coconut flour to 29 countries in the period from January to May ...

Village-owned enterprises (BUMDes), as the sole public legal entities in villages, are capable of preserving and ...

The Jakarta Regional Disaster Mitigation Agency (BPBD) reported that 92 neighborhood units (RT) in South, East, and ...

G20 Indonesia

Governor of Bank Indonesia (BI) Perry Warjiyo reminded all members of the G20 to address the risks of financial ...

News Focus

Bank of Indonesia (BI) recorded a spike in digital transaction users, reaching 21 million people in 2022, owing to a ...

The implementation of cross-border payments is still posing several challenges, such as high costs, limited access ...

G20 Indonesia

Since its launch on August 17, 2019, as many as 18.7 million merchants and users have registered to use the Quick ...

Foreign capital of US$1.5 billion flowed into the domestic financial market in the period from the second quarter of ...

Bank Indonesia (BI) has said that digital banking transactions rose 20.82 percent year on year (yoy) in May 2022 to ...

Bank Indonesia (BI) decided to maintain the benchmark rate, or BI 7-Day Reverse Repo Rate (BI7DDR), capped at 3.5 ...

Bank Indonesia (BI) has revised downward its global economic growth forecast for 2022 to three percent, from 3.4 ...

Bank Indonesia (BI) is optimistic that Indonesia will meet the global standard for both payment system infrastructure ...