#directorate general of taxes

Collection of directorate general of taxes news, found 60 news.

Indonesian Finance Minister Sri Mulyani stated that Indonesia had a role to play in eradicating transnational crimes in ...

The Law and Human Rights Ministry is collaborating with the Directorate General of Taxes to monitor the investments ...

The national anti-money laundering committee will set up a joint task force to investigate suspicious financial ...

- with many people feeling it was disproportionate to his position as an echelon III official. On March 8, Finance ...

A legislator has criticized the tax boycott movement on social media, saying that it might have an impact on national ...

Finance Minister Sri Mulyani Indrawati has asked a cruiser motorbike club at the Directorate General of Taxes (DJP) to ...

The Ministry of Public Works and Housing (PUPR) is building an integrated Digital Service Information System through ...

Deputy Finance Minister Suahasil Nazara stated that 2023 will bring opportunities for Indonesia to find new sources of ...

The Finance Ministry's Directorate General of Taxes (DJP) clarified that the Taxation Regulation Harmonization Law ...

Decline in commodity prices, including the price of Crude Palm Oil (CPO) that became Indonesia's flagship export ...

The tax revenue target has been almost reached this year as a result of efforts to serve taxpayers well, according to ...

The Finance Ministry confirmed that the government will conduct revitalization of state assets in Cianjur District, ...

It is necessary to formulate an Appraiser Law to support and protect the duties and responsibilities of appraisers in ...

The government will continue exploring new tax revenue sources for 2023 so as not to rely solely on the potential ...

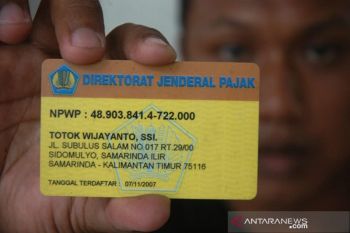

With the Directorate General of Taxes (DJP) launching the integration of personal identification numbers with ...