#taxation regulation

Collection of taxation regulation news, found 15 news.

The programs for reducing stunting and extreme poverty became the short-term focus of the Joko Widodo-Ma'ruf Amin ...

The Finance Ministry's Directorate General of Taxes (DJP) clarified that the Taxation Regulation Harmonization Law ...

The tax revenue target has been almost reached this year as a result of efforts to serve taxpayers well, according to ...

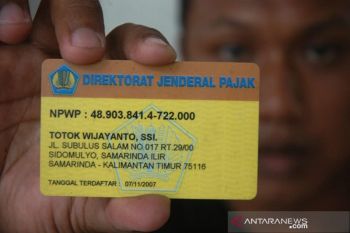

With the Directorate General of Taxes (DJP) launching the integration of personal identification numbers with ...

The youth's contribution to create a more sustainable and livable Earth has become increasingly important in ...

Directorate General of Taxes (DJP) and Directorate General of Population and Civil Records inked a cooperation ...

The increase in Value Added Tax (VAT) to 11 percent will have a minimal impact of 0.4 percent on inflation for the ...

The increase in Value Added Tax by 1 percent to 11 percent from April 1, 2022, is aimed at redistributing wealth to ...

Indonesia, having assumed the G20 Presidency mantle, should propose the formation of international tax commission, ...

Indonesia reduced carbon emissions from its power plants by 10.37 million tons in 2021, according to the Energy and ...

The integration of Indonesian citizens' identity card numbers (NIK) with taxpayer identification numbers (NPWP) ...

The government will not collect carbon tax from all business entities, with effect from April 1, 2022, official at the ...

A higher tax rate of 35 percent on high wealth individuals (HWIs) earning over Rp5 billion per year would hopefully ...

PT Freeport Indonesias parent company Freeport McMoRan Inc, said it would continue to operate in the country despite ...

Observers are split over the tax amnesty bill proposed by the government. Some said it is a breakthrough, but ...