#taxation

Collection of taxation news, found 571 news.

The Finance Ministry recorded that the state budget still recorded a surplus of Rp106.1 trillion at the end of July ...

A full membership in the Financial Action Task Force (FATF) will help Indonesia realize its vision of becoming the ...

On December 1, 2021, Indonesia assumed the presidency of G20 -- a forum of countries dominating 80 percent of the ...

Digital technology development has become one of the answers to enable people to remain active despite no face-to-face ...

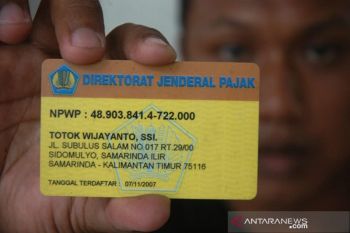

With the Directorate General of Taxes (DJP) launching the integration of personal identification numbers with ...

G20 Indonesia

The Indonesian government is seeking greater tax transparency among countries, government spokesperson for the G20 ...

Electronic system operators (PSEs) who fail to register on the risk-based Online Single Submission (OSS) system by July ...

Thanks to data integration, at least 19 million personal identity numbers can now be used as taxpayer numbers for ...

G20 Indonesia

The third Finance Ministers and Central Bank Governors (FMCBG) meeting within the framework of Indonesia's G20 ...

G20 Indonesia

G20 nations have agreed on the majority of the results of the 3rd Finance Ministers and Central Bank Governors (FMCBG) ...

G20 Indonesia

Indonesia is committed to bridging various differences and becoming the main supporter of multilateralism in the G20 ...

G20 Indonesia

Indonesia’s carbon credit export potential from further emission reduction efforts in the forestry sector has ...

Green economic growth should create new jobs with higher quality, so the green economy transition will not increase ...

G20 Indonesia

Communication and Informatics Minister Johnny G. Plate stated that the three priority issues discussed by the 2022 G20 ...

G20 Indonesia

- had confirmed their attendance at the event, Pambudi noted. However, several invited countries, such as Senegal, ...